Top observations from Earnings season (#3 of 3)

- Charles Miller

- Sep 5, 2023

- 6 min read

This is not investment advice and is general in nature. Do your own research before taking any positions in the securities listed below. You should consider your financial situation and goals before making investment decisions. This article covers mostly mid-to-small caps $LFG, $NOL, $ABB, $DSK and behemoth $MIN. The purpose is to zoom in on particular points of the results, not to go through them in their entirety

$LFG- Chasing riskier credit, will flow through into more BDD & lower div. But the opex saving potential is appealing

FY23 Results

Taking more credit risk for profits: To offset NIM pressures led by wholesale funding costs increasing, $LFG have skewed their origination in riskier products - notably Personal Loans and aggregation (i.e. Fin Services) and Auto loans (i.e. Secured).

To put this into perspective, when you look at Note 8 (Segment Reporting), the Profit (not NIM which does not allocate opex) from each segment was

1.5% for Residential

2.4% for Secured

5.2% for Fin Services. Noting the broking businesses have very big cost bases.

Whilst this sounds good, it is important to remember the loss given default for these different types of loans

Bear in mind here is the dividend cuts due to this credit risk creep.

Expect 12-18 months of NIM pressure: Given the 3-year tenor of their RMBS/ABS, they probably have 1- 1.5 years of their cost of funds unwinding from superficial lows.

Variable lenders still have their churn: Liberty/Pepper did not get impacted by the fixed rate cliff produced by the TFF (they are variable lenders). However, as they have higher rate products, they are still seeing churn (Resi - $1.3bn originated offset by $1.6bn repaid in H2'23)

Likely to see an ease in Opex Growth: I consider there to be a myriad of possible opex savings:

$9.9 million contingent consideration for 40% of equity in ALI is a once-off

There were increases in marketing ($3.7 million) and technology ($0.6 million) spend

Remember to factor in intangibles: Finally - I would encourage you to remember that whilst the stock trades at 1x Net Assets, a large chunk of this is intangibles

Conclusion - Whilst $LFG understand credit risk, their tilt towards auto/personal loans instead of Resi will come with larger BDD losses whilst experiencing NIM compression. That being said, I think they have a significant ability to make opex savings and their valuation is not demanding at a $1.1bn market capitalisation

$NOL- Higher margin to come from Direct business. Costco partnership is interesting. Reporting controls are a bit weird

Under-earning in Direct: During the call, Philip Pepe asked about the op margin for the Direct channel. Management confirmed that they increased reserves for Direct IP for the period so they think they will see c.200bps margin expansion in future periods

Costco Partnership is a win: The Costco endorsement is a big deal because they usually take a product exclusively, they have >150k members in Aus and it is evidence that $NOL is the cheapest in its marketplace

IT Costs of $1.5m to flow through: There is $2m of IT spend, of which $0.5m has been incurred today. If all of this is capitalised next year, it should

Impact of AASB17 unknown: This is a very complicated issue for life insurers, however, generally it will make $NOL's numbers look worse

Deferred acquisition costs are written off

P&L will generally be more volatile (albeit the same total profit over the life of a policy)

Embedded Value unknown: This is a concern for me that comps (i.e. Clearview) actively communicate the embedded value where

Conclusion - From a P&L perspective, $NOL is under-earning on their direct channel which I think will result in stronger FY24 results. However, from a valuation perspective, I do not know what an appropriate P/NAV for this company is given a lack of clarity on a) AASB17 write-downs b) what the current Embedded Valuer is. As such, I think $NOL is a buy for those who can handle some volatility as disclosures come through

$ABB - Gaurav is right on this one; great biz & their growth in fibre rollout needs to be monitored

Unlike the others, I won't write a big piece for this but would encourage others to follow Gaurav's take on the stock (Intelligent Investor). Generally, my stance on this result was:

Whilst the transition to fibre will permanently expand margins (Fibre = >50%, Resi = 30%) they are still relatively early along this journey

Management provided a relatively wide range of fibre capex which means where they land in this range could impact FY25 onwards more than you think

White label volumes/margins remain abnormally strong and I would see these ease going forward

Whilst there have been some changes in management, strong management ownership remains

Conclusion - The fibre build-out will permanently wider margins. Given the range in possible fibre capex for FY24, I think management are still unsure how quick take-up will be. I am slowly looking at acquiring a stake in $ABB noting it has run quite hard recently.

$DSK- Results were poor. Interim CEO was opaque. There is some cost-out and capex savings next year & let's hope the new website is better

I no longer hold this company (a good learning). However, I still followed their result given the obviously low valuation

CEO transition: This result was presented by the interim CEO/Chairman. Stylistically, he used a lot of generic/positive statements in lieu of detailed Q&A responses. Let's hope the incoming CEO (Vlad) can be more specific & detailed in insight

Style drift: Lately there have been interesting changes in strategy:

Re-engaging with regional stores after closing these pre-IPO

Re-exploring sales via non-retail distribution channels after

Whilst there is nothing per se wrong with changing one's mind, it is indicative of a lack of clear strategy

LFL sales in Jul'23: LFL sales in July, whilst weak, are not significant because July is not a significant trading period and last July cycled seas

RMB Exposure: Since half-year results there has been a 10% appreciation in RMB vs AUD which will help COGS

Big cost-out: Since 30 June $DSK have cut costs by c.$2m ($1.4m employees, $0.3m premise, $0.3m suppliers) and capex next year will benefit from lower store roll-out and refurbishment. Whilst this is of a high base, it is promising

Online sales are still in their infancy: Lower refurb costs will be partly offset by a revamp of their website. It is worth noting that FY23 penetration has not moved on since FY19)

$KLS- Whilst I remain optimistic about their US expansion, let's not forget the poor EPS track record so far

Recurring, one-off Adjustments: Whilst this was a particularly impacted year, I think $KLS should not normalise financials for:

Acquisitions - will occur regularly (e.g. whilst AAAHI was a big acquisition, they will continue to do bolt-on deals like "Go Ahead Group")

Impairments - new operations will often result in impairments

Wage pressure - will continue to be an issue for their 11k workforce (e.g. SG has large absenteeism due to labour reform)

Excluding transaction costs, $KLS really made c. $150m OpCF: AAAHI suppressed OpCF, which would have been c.$150m otherwise. On fact value, this is appealing given the $1.6bn mkt cap. However, let's not forget that this has been fueled by a) share issuances and b) is offset by some chunky capex as shown below

US Business more binary: There are pros/cons to the US businesses. However, the most important benefits I see are:

Shorter tenor and market-not-fixed reviews are likely to be misvalued by the market (compared to other parts e.g. 13yr tenor in Marine business)

The deployment of Graeme Legh there and strong customer retention suggest is is going well

Whilst California, a large chunk of AAAHI, is viewed as a poor operating environment there are nearby adjacencies

Conclusion - The strong management alignment and the focus on capital allocation means that I would not bet against $KLS. That being said, I think there are inherent risks for a capital-heavy business persuing bolt-on growth with a history of dilution. I need a bigger margin than 22x NPATA (or 30x NPAT) in valuation. Finally let's not forget the issues StageCoach had in Nick Sleep's fund

$MIN - Capacity to manage cash flow & gearing, however, I personally want to see a lower Spod price or Bald Hills/Ashburton play out before I top-up

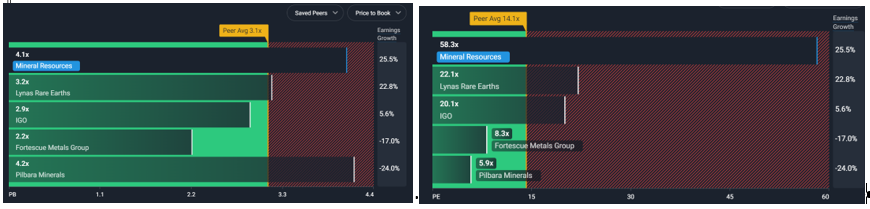

WIP is valued in: Whilst management should be proud of their >20% ROIC, the claim that "$5.5b of pre-earnings WIP is not factored in", is a complete lie. Their relative multiple is very high

A lot of levers to manage debt: Understandably with a falling commodity price, there is some focus on the solvency of this business. However, I consider it unlikely to be an issue because:

Mining Services makes $2/tonne EBITDA throughout the cycle

Gas exploration can be dialled up/down

Sustaining capex for iron ore is at an all-time high ($225m or $13/tonne)

Most financial metrics are ok - Gearing of ~44%, ND/EBITDA of ~1.6x and EBIT interest cover to ~4.9x.

Proven access to the bond market

Pre-Bald Hills, Lithium was still a massive driver: Lithium is 81% of their total EBITDA

Plenty of M&A activity: As well documented, $MIN is interested in:

Recently entered into an IA with the administrators of Alita Resources regarding Bald Hill lithium mine in Western Australia.

Significant holding in $DLI

Recently took over Norwest

Conclusion - Clearly Ellison knows what he is doing, however, there are plenty of variabilities ahead for both earnings and balance sheet driven by a) Bald Hill bid, b) Norwest integration c) Ashburton completion and to a lesser extent d) Wodgina ramp-up. As such, I am not chasing $MIN at full valuations to peers.

Comments