Screening out 10 businesses (2 of 3 - Global Mega cap)

- Charles Miller

- Jan 29, 2022

- 6 min read

Updated: Jan 31, 2022

This is not investment advice. Do your research before taking a position in any of the securities mentioned in the post below.

Following on from my previous post, today's post covers the screening process for Global Mega-caps. Admittedly I have a skew toward the US and Western Europe and although there are plenty of opportunities in Asia or Eastern Europe - I simply do not have the time to assess these.

Since we are covering Global Megacaps, there is often >10 analysts covering the stock so I do not try to disprove their thesis... I simply think is this something I want for the next 5-years regardless of how good/bad their quarterly earnings are. Today's businesses are Boeing (US), Unilever (UK) and Danher (US)

#1 BOEING ($BA) - THE THESIS IS SLIGHTLY MORE DIFFICULT THAN COMMERCIAL PLANE VOLUMES ARE COMING BACK

Snapshot of $BA

We all know Boeing, however, we may not know that they operate in three divisions 1) Commercial Airplanes (BCA); 2) Defense, Space & Security (BDS); and 3) Global Services (BGS).

Along with Airbus, $BA is one of the two major manufacturers of 100+ seat aeroplanes for the worldwide commercial airline industry

Yes - it is one of the bigger defence contractors, however, unlike Lockheed Martin/General Dynamics/BAE/Oshkosh, $BA it is more leveraged on the sale of commercial clients than defence

In terms of products - there are heaps of planes but the main commercial products to consider are:

Small Passenger (737 MAX): A newer commercial plane carrying 180ppl. Given its specialty in shorter haul flights, it has been more important post COVID-19

Larger Passenger (787): Holds 280ppl. Given the small volume of long-haul flights, this will lag

Freighters (777Freight): There is a suite of different products; with the 777Freighter being a focal point given it is long haul freighter (short-haul/eCom style planes have grown well but are generally less profitable)

A summary of their revenue by sector is set out below

Nuances about $BA business

Structurally, $BA is under-earning at the moment - which is usually very appealing for value investors, however, I think there are some factors that work against the company and explain why I did not proceed to invest

Need for cash & debt constrained: The mismatch between the level of Boeing production and the level of demand post-COVID19 has meant they burnt a lot of cash and therefore a capital raising is likely to take place this year given the huge cash consumption and they

2. Services is where the money is so the impairment is concerning: To the extent, the airlines can defer maintenance (and stay compliant) they will. The reason why this is not ideal is that $BA generates c.13-15% operating margin on this part of the business vs. 5-9% from the defence business. Whilst I do not know the detailed outlook for the services business, the impairment suggests it will have lower operating profit beyond just 2021..

3. Market expects reversion: The market is already assuming 2023 margins will have bounced back to 2018/9 levels; however fundamentally this requires Boeing Commercial to sell a more long-haul plane and maintain a reasonable defence margin... whilst this is likely you do not get rewarded for taking this risk

4. Alternatives in Aeronautics: At a super high level, if you are looking at comparative business models:

Lear which specialises in parts of the aeroplane componentry arguably is more resilient to pandemic-style downturns

Lockheed Martin is leveraged on defence spending which whilst political is generally more resilient than commercial business

Safran is almost similar to Lockheed Martin but focuses more on the European defence market and has a commercial business (albeit not focused on similar passenger assets)

Conclusion: The lack of debt headroom, need for future equity raisings and structurally lower outlook for commercial aircraft means that $BA's short-term outlook is weaker. I am fine with that if the long-term outlook is underpriced. The issue is that whilst the business is not trading a high revenue multiple, the market consensus is that margins revert and I think there is more risk to the downside that $BA do not achieve this than to the upside

#2 UNILEVER ($UNI) - WHEN YOU HAVE TO BUY GROWTH ITS NOT A GREAT SIGN

Snapshot of $UNI

Unilever is a global leader in both Foods (55% of group sales) and Household Products (45%).

Brands include Spreads & Cooking Oils (Flora, Rama), Savoury & Dressings (Knorr, Bertolli), Beverages (Lipton), Ice Cream (Wall’s), Personal Care (Sunsilk, Lux) and Household care (Persil, Omo).

Set out below, Unilever are looking at selling key brands (e.g. Ben & Jerry's)

Despite Unilever clearly owning strong brands - its underlying sales growth has underperformed the likes of Nestle in the last 5 years due to their favouring bolt-on M&A over brand and capex investment

The GSK deal

Long story short - Unilever offered £50 billion for GSK's consumer division

Not liking this offer, GSK is courting the sovereign funds of Qatar and Singapore as cornerstone investors in a listing of its consumer business

GSK is selling their household products business which could prove highly desirable, however, my concern is two-fold:

Unilever sell their brands (Ben & Jerry's, Marmite and Hellmann's) given the GSK transaction/M&A environment

Unilever is again pursuing an M&A tactic, even if GSK's business could be a great buy for them; they have been smart enough to launch higher bids for the company

Nuances of the Unilever business

Recently Unilever announced quite a material restructuring which cut senior management (even if many speculate it was due to activist pressure)

This may show a pleasant renewal in focus on brand growth over M&A because - as shown below... M&A activity has not panned out well for the company...

Examples of competitors who have run their business better than Unilever include

Nestle - The ultimate in diversified players. Growth has come from Pet, Baby Milk, confectionery and fresh roast coffee.

Reckitt - Dominates household cough & cold remedies

Danone - Recent growth has been driven by an improvement in total yoghurt/dairy returns

L'Oreal - despite a drop-off in cosmetics sales from COVID-19 this has seen a material recovery

Note - in the household sector Beiersdorf and Henkel have struggled demonstrating it is not just Unilever finding tough time in this space

Conclusion: Unilever has some incredible brands and operates in the enviable consumer staples space however it has had a medium-term trend of under-investing in brands and over-allocating to M&A activity. Yes, there has been a general trend to generic brands (as seen by the lagging price of Kraft Heinz) but overall - I need to see a material restructure for this business is needed to compete with Nestle, Danone or Reckitt.

#3 DANAHER - AMAZING BUSINESS, BUT RISK AND LEVERAGE IS UNDERPRICED

Before I start - this article was originally meant to be about Novartis due to its lower growth and highly technical products (e..g outside of my area of competence). However, compared to Danaher - Novartis is financially more defensive and leads certain product types.

Snapshot of $DHR

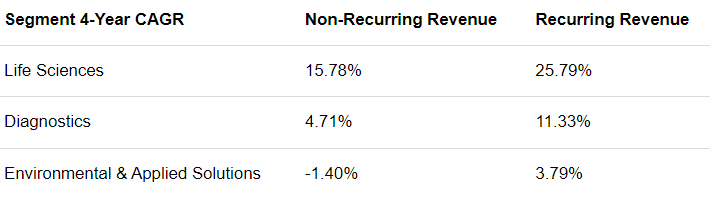

Danaher three segments are: Life Sciences, Diagnostics, and Environmental & Applied Solutions; with Life Sciences now being the real engine for Danaher

Founded by the Rales Brothers, and champions of the Kaizen approach to management/manufacturing there is no refuting that Danaher is one of the market darlings; for a good reason... they have a very strong recurring revenue base which has led to year-on-year margin growth

COVID-19 testing has been a big tailwind for Danaher

Danaher have forecast $3.6bn of COVID-19-related revenue ($2bn of vaccines and $1.6bn of testing/diagnostics-related revenue)

Like all things, it is tough to know how much this will drop off however it should taper down in 2-3 years and they are likely to need to find new M&A to bridge these gaps (their market share is shown below)

Recent acquisitions such as Cytvia (2020) and Aldevron (2021)

In terms of growth outlook, Danaher has made it quite clear that Life Sciences is their big growth engine. In the last two years - their business has been bolstered by two major acquisitions

GE Biopharma aka Cytvia ($21bn/7k employees): enables the business to grow its contracting manufacturing. In particular, it helps them take advantage of the huge level of COVID-19 testing

Aldevron ($9.8bn/500 employees): this added protein production, plasmid DNA, and mRNA services

Whilst I have mentioned above in the Unilever analysis my general aversion to inorganic growth their track record does support their ability to acquire the right business at the right price

It has also helped them grow their business in Life Sciences where the returns are greater

Comments