$OBL - Mgmt fees & PF can offset huge overhead. US competition & strategy creep is the biggest risk

- Charles Miller

- Jan 6, 2023

- 6 min read

This is not investment advice and is general in nature. Do your own research before taking any positions in the securities listed below

We all know $OBL’s business, so I will keep this brief

Formerly known as IMF Bentham, Omni Bridgeway finances litigation in Australia, the United States, and Europe

The core of the business is funding individual cases, where $OBL will pay the legal costs of the suit and in return receive a portion of the win. A breakdown of the funding by cause is set out below

The acquisition of Omni Bridgeway in late 2019 provided three key benefits to the bigger group:

Expanded into other geographies with Case Law (namely Europe)

Moved from financing "legal judgment" into financing "enforcement of legal judgment" as well. This broadened the deal types of $OBL & arguably the enforcement product is less risky

IFM structured the acquisition in a way that numerous parts of the consideration were structured as 'earn-outs' or contingent upon certain outcomes

Initial thoughts on Litigation Funders & the industry players

Structurally, I am not a fan of litigation funders because:

Opaque: Despite this whole “uncorrelated with markets” argument the industry makes, the risk attached to the underlying cases can be difficult for a layperson to understand (even if there is a portfolio of cases)

Non-standard KPIs: Whilst it is not a bad thing that these metrics are tracked by Lit Funders, they report on KPIs that are not necessarily linked to P&L:

Implied Embedded Value - Originally more a Life Insurance term this represents the present value of future profits of a firm to the net asset value

Estimated Portfolio Value - This is a bit like "GAV" but it includes conditional deals. I would ascribe very little reliance on this metric but it is useful to see how big $OBL is vs $BURF.L

Self-funding risk: The biggest competitor to your business model is self-funding (i.e. the person being sued pays themselves). $OBL state that only c.5% of litigation uses a lit fund and whilst this may grow over time it is unlikely that this will be >10-15% without a big reduction in the cost of this finance

Judicial timeframes: The capital cycle can be long even if the pay-off is terrific, it shows in the capital drag of this business (e.g. $OBL's Wivenhoe case will produce 20% IRR but huge payout)

Enforcement funding counterparty risk: For enforcement funds, there is a big reliance on recovering charges against law firms and/or insuring this risk. This is well explained in Koda's interview with Katch whereby ultimately they may get ultimate parent guarantees but no firm has made a major recovery against a law firm

No moat: In theory, anyone can start a litigation fund, albeit $OBL has highlighted that starting a "good fund" requires scale, diversification and ideally Lit Fund track record

Who are their competitors in Lit Funding

Burford: one of the largest and most well-established litigation players. This company came on my radar as super investor Greg Alexander (Conifer) holds a material stake

Therium: Headquartered in London. The company has a particular focus on large, complex cases and has funded cases in areas such as competition law, professional negligence, and employment law.

Harbour: Based in London, this is similar to Therium but has a bigger tilt towards commercial disputes and product liability cases

Woodsford: Headquartered in London and has operations in the US, Europe, and Asia. The company has funded cases in a variety of areas, including commercial disputes and IP cases.

Ok – so what is appealing about $OBL?

The way I see it there are a few great things about $OBL:

Future FUM: In moving away from a pure-play lender to a fund manager – $OBL will get significant operational leverage (e.g.lower coinvestment and higher fees). Whilst the market knows this fact, their fund has not yet scaled materially (<$3bn committed) and the newer vintage funds are not yet to be fully deployed so it is fair to say the upside cannot be fully valued by the market

Legacy fund run-off: The legacy funds are rolling off and their new funds have performed wonderfully. Whilst the below chart from $OBL shows >80% IRR, the facts are the true IRR is c.30-35% because:

IRR is on a deal-by-deal basis & later vintages are yet to face impairments

IRR is stated before the cost base of which there are significant costs

Undeployed funds are being deployed in a competitive space

Plenty of fat in their fees: The fee card can be WAY better than say a mid-market debt or PE fund. This being the case, the real catalyst for $OBL is if their Performance Fees are strong over time & and if their FUM/Investment Manager is sufficiently high (currently $300m Committed per Manager)

Diversification: Excluding Fund 6, which is simply an 'enforcement fund', $OBL has worked hard to diversify FUM. Whilst there is a risk that this diversification means that $OBL has “strategy creep”, if they stick to the type of cases they are skilled at (single party, class actions etc) they

Scale is needed because overheads are high: They are a meaningful player in this sector (arguably the biggest behind Burford) and scale matters to cover their employee cost base (e.g. $59M p.a. from 199 employees, plus $29m of SG&A) so you need to raise material FUM to fund this

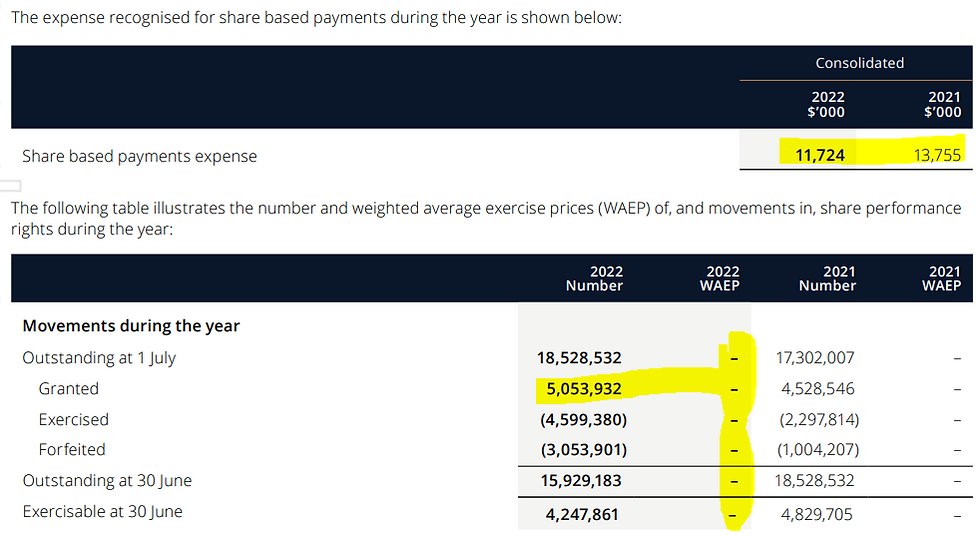

Also on the topic of wages, both $BURF.LN and $OBL pay about 15-20% of their salaries as share-based payments

c.18% for OBL in FY22 ($11.7m SBP/$59m)

c.22% for BURF in FY21 ($17m SBP/$74m; excl. legacy incentives)

Accounting approach: $OBL does not fair value the payout of its cases vs. Burford which leads to their NAV (excluding NCIs) being understated. For this reason, they trade on different multiples BURF.LN at 1.2x, $OBL at 2.9x (adjusting for NCI). Whilst I do not think this moves the dial on the business operations; I prefer $OBL's conservatism in approach as this impacts share based payments as well

Ok, so what is your valuation of $OBL

Before I start out below - the my valuation is very blunt. This is because I did not have time/information to run the level of case-by-case waterfall. Instead, I have done a backsolve to today's share price ($3.60) using 'run-rate' EPS over the next couple of years excl. Performance Fees (PF). It is likely that PF is a big number (particularly in non US funds which are less competitive) but it is difficult to ascribe value to these without the full fund waterfall and they are non-recurring.

The reason my blunt approach is a) fund roll-off mean EPS will be clumpy and b) it is tough to know when they will deploy the >$2bn of commitments they will likely raise in the next two years

Assumptions:

EPV converts to IEV at a conversion rate of 15% (shown above)

FUM grows by $2bn; adding c.$600m of IEV to $OBL in the next couple of years

Management fees of 2% and limited value are ascribed to PF

The litigation costs reduces down closer to c.30% in (in-line with Fund 6 structure)

Run-rate impairment is 25% (based on a 75% success rate) with the impairment being for the difference between IEV and cost - this is arguably the most discretionary assumption. However, it assumes a component of the costs are recovered via enforcements insurance

Share count grows by 7% p.a.

Valuation outcome: I can envisage that $OBL's FUM book (incl. growth) could produce $0.25/share of EPS before PFs. The clumpy nature of this IEV means it is difficult to know the exact profile so I have bluntly averaged it.

Conclusion: Overall, even though it is highly likely that $OBL will accrue big PFs in the future, there are a few concerns I have:

The operational nature of Lit Funding means that $OBL does not have the operational leverage of say an equity fund & gives away a fair amount of its FUM growth in headcount growth (e.g. FY23 FUM will grow by 25% or 15% per employee)

Similarly, employees are going to dilute shareholders by 5-10% p.a.

It is generally difficult to forecast impairment. Per the FY22 results the Success Rate was 77% however there are two offsetting considerations here:

Bear - Moving into new regions & products may see Success Rate fall

Bull - Many of these loans (notably enforcement) will be able to be insured against meaning the loss is not fully recognised

Based on the above valuation, which is imperfect, it is not trading on a 'crazy' cheap valuation

Whilst I take a small amount comfort in Conifer investing in Burford, the industry as a whole is yet to provide favourable returns for shareholders of the manager.

I will monitor $OBL closely going forward and for me to invest I would like to see either a) greater operational leverage b) understand the future PF/waterfall payments better or c) proof that impairment charges should be <25% going forward.

Comments