$MFG: Forget div yields - US/Core FUM & key person retention are the drivers to watch

- Charles Miller

- Oct 11, 2021

- 5 min read

This is not investment advice. Do your own research before taking a position in any of the securities mentioned in the post below.

As stated in previous posts; it is my preference to cover companies that do not get a lot of sell-side research OR companies that are facing a downturn (such as the recent posts about $BABA). MFG is the latter. Before diving into MFG, it is worth bearing in mind the following about investing in fund managers

Risks - Managers want lock-ups & fixed fees, but investors want liquidity & PFs

Even the best managers in the world have large fund redemptions and it can happen at good & bad times:

In a boom time - “Shame on you for not investing in Dogecoin –we want our money back”

In a downtime - “I lost all my money on Shibu Inu coin, I need my money back”

There can be a perverse relationship between a good fund vs. a good fund manager.

Investors in the fund - I want low fixed fees (in lieu of performance fees)

Investors in the manager - Funds should charge large fixed fees & have long lock-ups periods to fund my dividends

There is more "key person risk" than most other businesses. For example, it probably does not matter who manages a widgets factory, however, arguably a component of an investment “edge” is the money manager themself

Rewards - It takes years to be on the radar of pension/endowment funds

There is some “moat” insofar as it takes a 5-year track record to win big pension fund money. Additionally, certain strategies have a very TAM (e.g. global growth or global infrastructure) and can attract big FUMs compared to say small caps

Small caps managers can/do outperform, however, in terms of owning the manager this big TAM helps MFG

In a market downturn, these businesses often get oversold because of the fear of mass redemptions. Whilst this is a fair concern, most long-only fund managers have close to no debt at the manager level or fund-level and low fixed costs

Generally, these businesses produce cash > reinvestment requirement. Hence big dividends

MFG - What matters & what does not

The way I see it, there are really only four drivers which matter for this business

Volume - Ability to capture FUM

Margin – Ability to continue charging a decent margin for managing funds

Churn/return – Linked to 1) Ability to retain FUM through good investments

Efficiency – Converting fee income to dividends

Therefore, I think the following factors do not matter:

Principal investments: MFG has invested in Barrenjoey, Guzman & Finclear… whilst interesting, I think they are too small & non-core

Capital market outlook: There is no point in trying to guess the future of capital markets. Structurally - there will be demand for active management and a weak outlook helps your entry point

FX: MFG's earnings are linked to USD. Any movements in this are just noise.

I unpack these in detail below. Overall, my conclusion is that whilst there is a lot of merit in a long term investment in MFG at today's price, I generally prefer to invest in fund managers/LICs when the market outlook is weak and we are not at that stage. The key variable I would monitor is the FUM of their core/smart-beta products (in lieu of more expensive active products) and the retention of their impressive investment/distribution team

#1 Volume - subdued North America growth will be partially offset by ROW/ANZ

Despite recent negative press, growth in FUM growth since inception has been impressive, even if institutional FUM growth has slowed in the last 2 years (off an explosive rate).

FUM tapered off a strong base Lack of product types = mid-table FUM growth

They are underweight retail in Australia Leveraged on Global Growth equities

Overall - my guess is that there is a blip in short-term growth, followed by 6-8% longer-term FUM assumption fuelled by lower margin core products.

US FUM growth % will likely lag ROW/ANZ: The weight of competition from US alt funds (Hedge Funds, PE, late-stage VC etc) means that one should assume lower growth in this competitive market

Losing key distribution staff is a risk: Compared to most, MFG's key-person risk is high and this is particularly the case for distribution/investment staff who unlike the founder may have a larger component of their net worth outside of MFG shares

Slow growth could perversely help FUM: MFG's aversion for pre-profit tech/biotech stocks is seen as a bad thing in today's bull market, but they will likely benefit if/when these stocks blow up.

Brand preservation > FUM: Global equities space is so large that they can grow various products (e.g. ESG, Infra or an Asia-focused fund) without eroding their brand. Expanding into non-core products (e.g. value or hedge funds) without structure and simply chasing FUM could be adverse for the brand

#2 Margin - the Core product will grow but I think +50bps margin will sustain for 5yrs

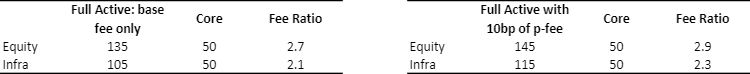

The recent move from active assets to "smart beta" FUM and other funds means that the fees are materially lower; even more significant if there is a loss in performance fee. Shown below

There is an argument that this will bring with it lower costs because it does not need the personnel resource. Whilst there is some merit in that, I think the cyclical PF income which core products lack still means lower income

Conclusion - I think fees on FUM will compress from 61bps to 50bps by 2025 partially offset by FUM growth. Whilst conservative assumptions should be made about future PFs, I do not think margins will compress to <50bps before 2025 because of the larger margin earned on its retail funds and the prospect of future PFs.

#3 Churn/Return - Prior performance is no guarantee of future performance

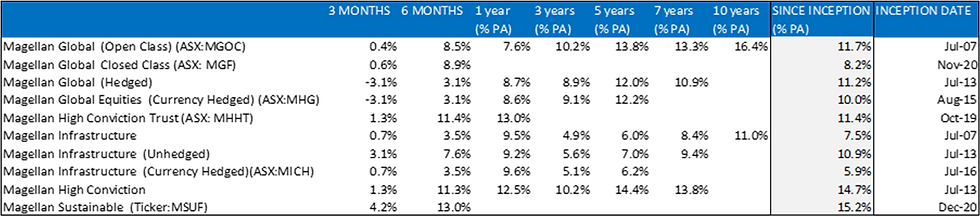

Below is a summary of Magellan fund returns. I don't have the benchmarks but global growth and infrastructure have outperformed since inception with the High Conviction fund being weighed down by Tencent/Alibaba

As is to be expected, MFG'smore concentrated funds can be weighed down by negative positions (e.g. Alibaba) or more FOMO from good performers (e.g. Tesla or Amazon, the latter which is now a holding).

Conclusion - this is the hardest driver to properly assess. Personally, I consider that concentrated/active management in global growth stocks will always have a place. This is why I consider there to be scope for FUM growth net of churn

#4 Efficiency - Buybacks left wanting, however, LT ROE has been strong

Over the last 8yrs, there are three conclusions to be made about the efficiency of MFG:

Pre-2021, ROE was very strong, with the move to principal investing/core products weighed this down in 2021

Their cost to income ratio, whilst still high has become much more competitive

Shares on issue expand by 2.5% each year; likely due to DRP. Notwithstanding tax considerations, more could be done to undertake a share buyback

Conclusion - principle investments weighing on ROE is a one-off and we should not forget the strong historical ROE. The cost-to-income ratio is a key thing to monitor as MFG weigh up the balance between manager retention and lower-fee products.

Comments