$MAQ – Friendly illiquidity with a downgrade opportunity

- Charles Miller

- Mar 10, 2023

- 4 min read

This is not investment advice and is general in nature. Do your own research before taking any positions in the securities listed below. You should carefully consider your financial situation and goals before making any investment decisions.

Prelude on illiquidity

Howard Marks has often said that "readily observable quantitative data" that suggest a company is cheap/expensive is not a source of edge. Whilst I loathe quoting famous investors - he has a point.

With this in mind, earnings multiples in isolation are not an edge for retail investors. However, a possible edge can include illiquid stocks, smaller/less-covered companies, companies facing a 'one-off' event or indeed concentration differences vs. an index. Now of course - none of this is easy, and if you get it wrong you'll certainly underperform an index, but this is a reason why $MAQ first appeared on my radar a few years back (due to it's illiquidity)

A brief introduction to $MAQ - You probably know this part

$MAQ is generally well covered, however, as a reminder:

$MAQ has 3 divisions; telecom, governmental/services (including colocation) & data centres

Whilst you would consider their competitors to be the typical Tier 3 data centre (AirTrunk, NextDC, Equinix etc) - the primary source of growth has been from getting customers to move small subscale IT providers to Tier 3 data centres

In terms of their division as, most growth come from government/services in 2016-20 and from 2020-23 data centre has started to add materially (capacity being 54MW; with limited detail around contracted rates/sqm)

Their clients are a mix of hyper scalers & corporate with the latter generating 8-10x more margin than the former

$MAQ is thinly traded because 60% of the register is owned by the Tudehope family

Despite the large capex profile for this business, they have managed to grow the business without dilution (albeit their gearing is now akin to $NXT)

They will likely hit their FY23 EBITDA target of $102-4m, however, very little of this trickles down to NPAT due to D&A of the large capex profile

Op CF + Maintenance Capex is the better metric to value this business; not NPAT (as a reminder NPAT is tiny vs Op CF)

Why look at them now - I think there will be a catalyst to the downside

In the short term, $MAQ will probably hit its 2023 EBITDA target of $102-$104m and deliver on its build-out of IC3, however, I think there could be a catalyst to buy up at a c$50 price or below

Cost of debt: The weighted average cost of debt c.4.7% and they will need to draw more debt at higher costs (i.e. $59m of headroom vs $40m pa requirement). This is particularly important given IC3W will be built shell & core using bank debt at higher rates than previously achieved

IC3W Approval timing: I consider there to be a small chance that there is a delay in their DA (State Govs want DCs) to build the 32MW IC3W data centre at its Macquarie Park campus which would be adversely received by mkt

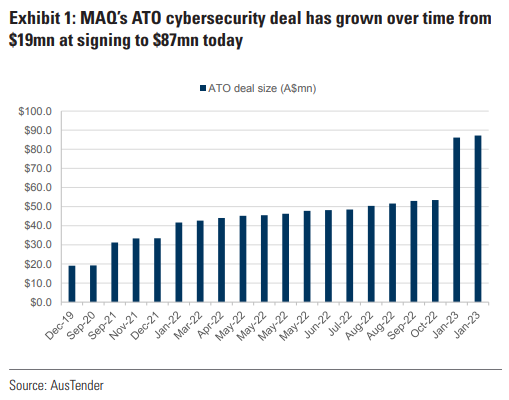

Sensitive to ATO contract deferrals: Even though the user case for the ATO goes without saying... you can see that earnings today have benefitted from a one-off growth event. This revenue will recur but growth rates may subside

Power costs pinch: From an LT demand perspective, high power costs are beneficiary for $MAQ vs. Tier 2 data centres. However, without full visibility of their customer book, I envisage there could be some power cost increases that $MAQ wears from their hyper scaler clients

$NXT is essentially running 65% occupied: Whilst it is not quite this simple - $NXT has 84MW contracted vs.129MW capacity. Whilst not all of this can be mobilised today -c.15MW has been “pulled-forward” at S3 of ~10MW and M3 of ~4.5MW.

General IT spend: From a pure sentiment standpoint, it is plausible that semi-gov and enterprises pause their IT spend; noting that hyperscalers have already started

Efficiencies from Telecom business: Whilst they have been incredible at slowing the decline of their traditional telecom/voice business, I would not be surprise if this slowdown increases to c.4% p.a. reduction in revenue in future periods

So much pessimism - so how can you play this?

Whilst I have built up a more detailed valuation, the common sense approach here is:

EBITDA will easily grow at 13% p.a. off a base of $104m in FY23

Since NPAT is not a great proxy for valuation for this company, you may consider an EBITDA multiple which has some resemblance to the LT growth rate (i.e. 1x PEG for EBITDA; which I know is a weird basis)

Put another way - you can probably assume an 18x multiple for the data centres, 6x multiple for telecom and services is probably somewhere in between

Assuming a 13x EBITDA multiple it would yield a $1.35bn EV or a c.$50/share purchase price

So overall - I have not loaded up on $MAQ for some time and whilst the price today of $60 is ridiculous, I could get some comfort around c.$50 mark. And instead of "praying" that it for it to happen, I think there are plausible catalysts:

ATO contract wash-through lowering growth

Rising cost of debt with limited headroom on their 32MW core development

Opex cost increases (power) not being fully passed on

Hyperscaler demand being subdued and NXT having capacity

I may be wrong and it may moon to $100 - but I would rather wait for one of these catalysts to achieve my entry point .

Comments