Insiders unload Dusk, outsiders think it's cheap

- Charles Miller

- Sep 20, 2021

- 3 min read

This is not investment advice. Do your own research before taking a position in any of the securities mentioned in the post below. The author may hold positions in any of the securities mentioned.

Based on financials, you could be excused for thinking that Dusk Limited (DSK:AX) is a screaming BUY. The well-known candle retailer demonstrates the following favourable characteristics

Trades on a trailing 9x P/E and an EV/EBITDA of c.5x

Huge sales & profit growth; Pre-IPO NPAT of $5m in 2019 to $30m in 2021

GM% of 68% and great cost management (CODB at 40%, down from c.50%)

A large number of loyal participants c.600k Dusk members

Strong unit economics with c. $1.1m generated by each store

Promising signs of both growth to online sales (7.5% of 2021 sales) and the prospect of overseas expansion to UK/US.

Nil debt & net cash position of +$20m

So what are the insiders doing

Yet despite all of that, the CEO (Peter King), BBRC (Brett Blundy) and Catalyst Investments (led by Simon Dighton, Trent Peterson, and John Story) trimmed 5%, 28% and 25% of their respective holdings.

The sell-down by Catalyst is not necessarily a concern, because they are a PE fund that needs to maximise returns in a finite period. Similarly, the sell-down by Peter King was relatively small (so less of an issue).

Equally, Blundy’s sell-down in April 2021, also should not have been that much of a concern - BBRC had been invested for +10 years now and the IPO gave BBRC a way to redeploy capital into other ventures.

At least part of my inner cynic indicates that this was an early warning sign that FY21’s earnings were severely inflated by Jobkeeper and that FY22 will be flat-to-negative.

Putting this in contrast to Lovisa which trades on a much higher multiple; Blundy has not sold down his 40% stake. Just a thought if you're looking solely at multiples.

What will FY22 look like for Dusk?

Dusk’ FY21 Investor Presentation indicated trading for the first 7 weeks of FY22 suggests LFL sales are down 11% (physical stores -17%; online +26%).

Even as Australia follows the rest of the world by opening back up, it is not unreasonable to expect people to shift their spending from homewares to restaurants, leisure & clothes. At least that is what we are seeing in the US where Lovisa’s is booming

So when do you buy a company with negatives sales growth next year?

The short answer is, it really depends on your time horizon. If you were to extrapolate out Dusk's trading during this lockdown (arguably that is a bit harsh because Australia will open back up) and assume a multiple of 7.5x, similar to their LT earnings growth, you could be willing to acquire Dusk at $2.43 (i.e. you're hoping for a 22% fall from Friday's stock price)

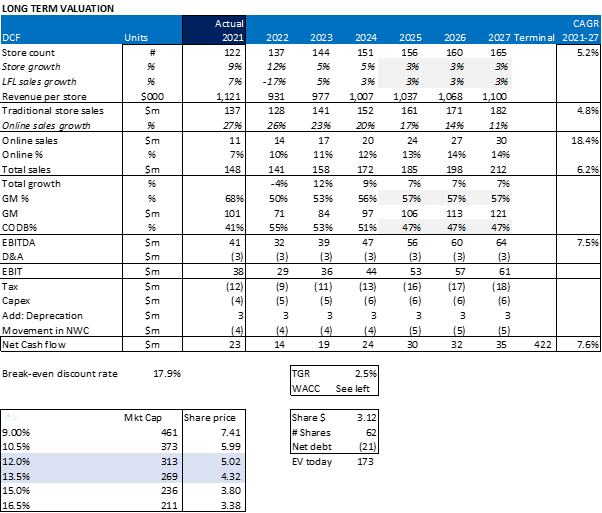

Conversely, if you were to assume a consensus long term growth of 7.5%, there appears to be a decent margin of safety from today's share price. The key drivers are:

GM% sit at +55% products as they grow OR in a more likely scenario they achieve offsetting store roll-out overseas

Online growth continues to be strong (this generally appears likely)

Management continue their strong cost management approach (i.e. 45% CODB)

Overall - I think someone buying Dusk today is exposed to sizeable earnings deterioration in FY22 as Australia stays closed. What's more, the market is likely to disproportionately punish Dusk when other retailers hit their targets & Dusk misses.

Nonetheless, if you look past this you do not need to bake in much growth in 2022 onwards to justify it as a long term hold.

Comments